- June 3, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

The Monochrome Bitcoin ETF (IBTC) is poised to make history as Australia’s first spot Bitcoin ETF, set to launch on June 4, 2024. Trading on Cboe Australia is scheduled to begin at 10:00 A.M. (AEST). Issued by Monochrome Asset Management, IBTC will be listed on the exchange under the ticker symbol IBTC and will track the CME CF Bitcoin Reference Rate – Asia-Pacific Variant.

“IBTC is expected to commence trading on Cboe Australia on Tuesday, 4 June 2024 at 10.00am (AEST)”.

With a management fee of 0.98%, Monochrome’s ETF aims to give investors direct exposure to Bitcoin through a passive buy-and-hold strategy. Notably, the fund will not engage in derivatives, leverage, or short selling, emphasizing a straightforward approach to Bitcoin investment.

“The Investment Manager will implement a strictly passive buy and hold investment strategy for bitcoin. The fund will not use derivatives, leverage, or short selling”.

This launch follows a global trend of spot Bitcoin ETFs gaining approval in several major markets, including the United States, Hong Kong, and the United Kingdom, earlier in 2024. The introduction of IBTC marks a milestone for Australian investors seeking regulated and accessible Bitcoin investment options.

Currently, Bitcoin is priced at AUD 103,810, reflecting its growing appeal. Recent prices hit an all-time high of over AUD 110,000 in March. The arrival of IBTC is expected further to enhance digital accessibility and appeal in the Australian market.

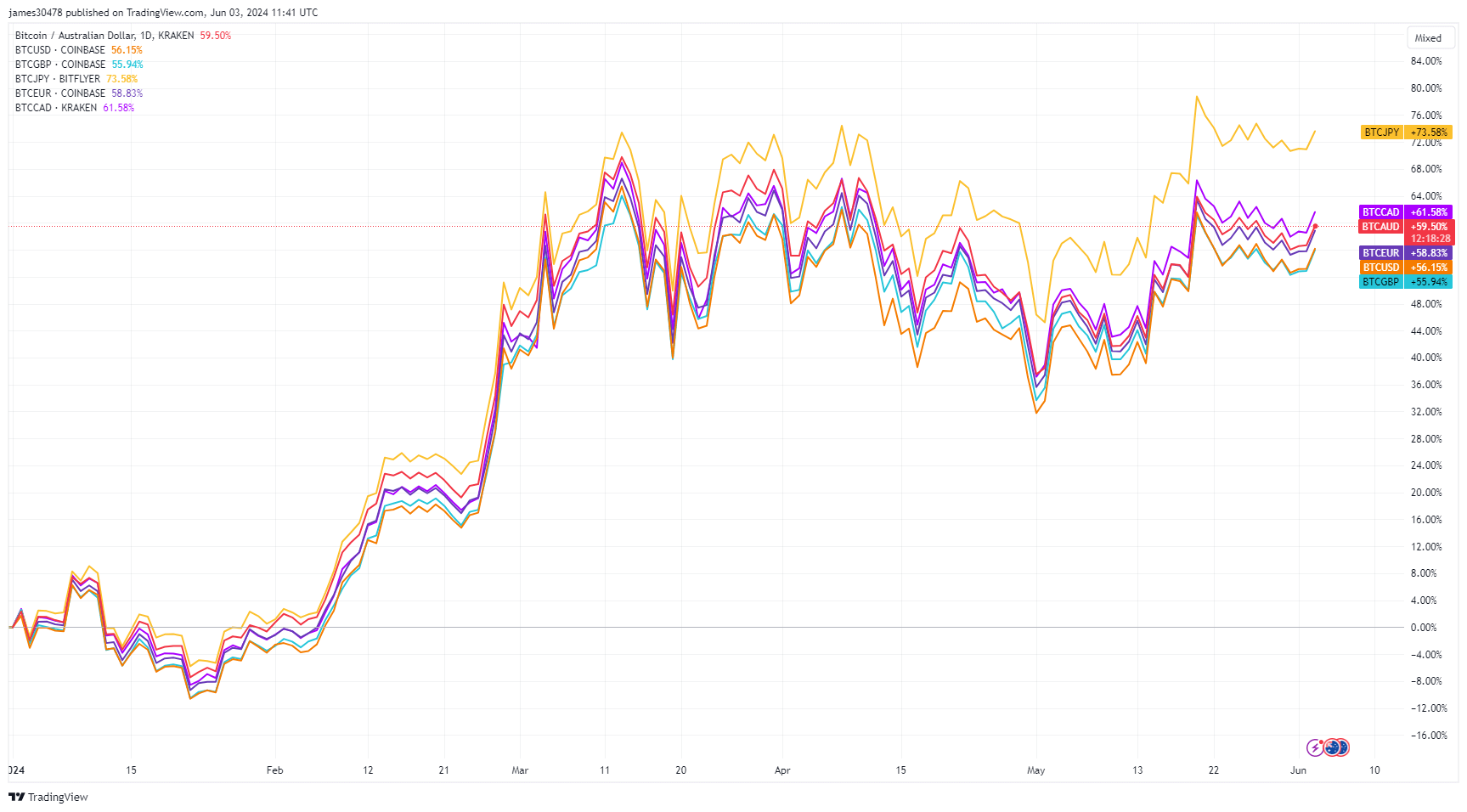

Bitcoin has shown significant year-to-date performance gains across various major currencies:

BTC priced in Pounds (GBP): 56% increase

BTC priced in US Dollars (USD): 56% increase

BTC priced in Euros (EUR): 59% increase

BTC priced in Australian Dollars (AUD): 60% increase

BTC priced in Canadian Dollars (CAD): 62% increase

BTC priced in Japanese Yen (JPY): 74% increase

The post Monochrome to launch Australia’s first spot Bitcoin ETF tomorrow appeared first on CryptoSlate.