- May 3, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

In the ongoing legal battle between Ripple Labs and the US Securities and Exchange Commission (SEC), pro-XRP community lawyers have offered a pessimistic outlook for Ripple’s latest court motion. Attorney Jeremy Hogan, known for his vocal support of Ripple in the crypto community, expressed via X (formerly Twitter) that he anticipates a loss for Ripple in its recent legal maneuver.

Ripple Will Lose This Time: Pro-XRP Lawyers Claim

Sharing his thoughts on X (formerly Twitter), Hogan remarked, “The hardest thing to do on CT is say that you think the SEC will win a motion. But HERE GOES: I think the SEC will win this motion.” He elaborated that even if the court recognizes the SEC’s witness, Andrea Fox, as an expert, the likely outcome would be similar to previous cases, where the court allowed Ripple to depose the witness rather than striking them from the record entirely. Hogan concluded his statement with a humorous but serious remark, “Now, excuse me while I go pray I’m wrong, which is not often.”

The discussion was sparked by an update from James K. Filan, a former defense lawyer, who reported on Ripple’s filing of a letter in further support of its April 22, 2024 ,motion. The motion was a reply to the SEC’s opposition, which had been filed a week prior, on April 29, 2024.

#XRPCommunity #SECGov v. #Ripple #XRP @Ripple has filed a letter in further support of its April 22, 2024 motion to strike new expert materials, and in reply to the SEC’s April 29, 2024 opposition to that motion to strike. pic.twitter.com/vXW1C22Oso

— James K. Filan

(@FilanLaw) May 2, 2024

Bill Morgan, another attorney advocating for XRP, shared Hogan’s sentiment in a separate post. Morgan stated, “I think Ripple will lose the motion but the judge will accept Fox gave some expert evidence and permit Ripple to depose her. Then we can see what SEC says on May 6 in its reply brief on remedies and then await a decision on remedies.”

Notably, the court dealt with a similar situation involving the “Ferrante Declaration” earlier in the case. This declaration, much like the later Fox Declaration, was used by the SEC to summarize financial data and calculations concerning Ripple’s financial activities. Ripple had opposed this declaration, arguing against its admission, but the court permitted it as summary evidence, not as expert testimony.

However, Judge Torres allowed the declaration, treating it as permissible summary evidence under the law, rather than as expert testimony. This previous decision is likely what Jeremy Hogan refers to with “like it did before,” indicating a precedent where the court allowed Ripple to challenge a witness through deposition instead of striking the witness entirely.

Background Of The Motion

At the heart of the dispute is Ripple’s objection to the SEC’s expert declaration by Andrea Fox, which Ripple argues has been improperly categorized by the SEC. According to Ripple, Fox performs a deep analytical review of Ripple’s financial records, drawing conclusions that influence core aspects of the case, such as disgorgement calculations and pre-judgment interest.

According to the filing, “Fox analyzes Ripple’s records, third-party evidence, and expert reports; draws inferences and conclusions about those documents; and calculates disgorgement, prejudgment interest, and discount amounts based on her analysis.”. Ripple emphasizes that this level of analysis requires more than basic arithmetic, countering the SEC’s portrayal of Fox’s role.

Ripple further accuses the SEC of failing to disclose Fox’s involvement as an expert witness during the discovery phase, which they argue is a requirement under the court’s scheduling order. The filing details that the SEC’s late disclosure of Fox does not comply with the agreed timeline which was set to complete remedies-related discovery by February 20, 2024.

“Discovery could not be ‘completed,’ as the Court directed, if the SEC had not yet disclosed a witness whose testimony the agency planned to present and whose deposition Ripple had reserved its right to take”.

Moreover, Ripple contrasts Fox’s extensive and detailed declaration, which includes specialized accounting assessments, against previous summary witness testimonies cited by the SEC, which involved straightforward data compilation without analytical interpretation.

Ripple concludes that the SEC’s approach to Fox’s declaration and her qualifications contradicts their characterization of her as a non-expert, summary witness, and thus, her testimony should be struck for non-compliance with the discovery rules.

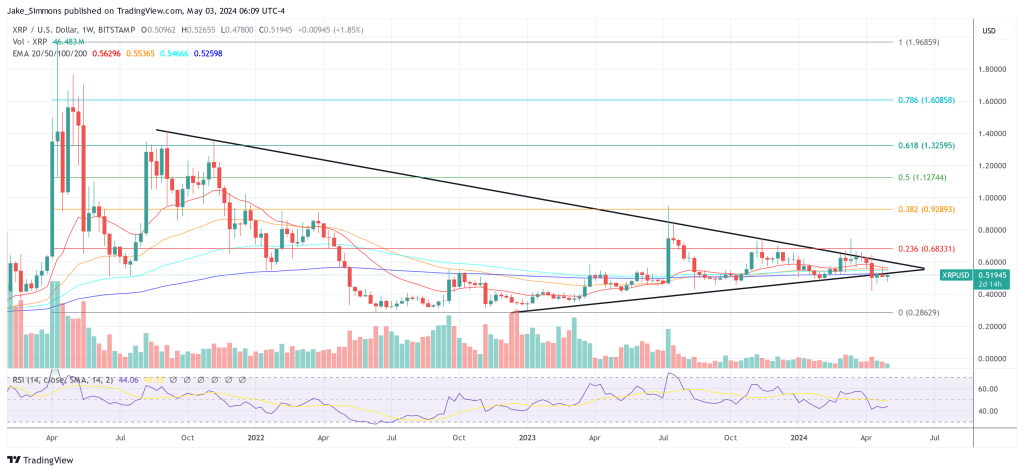

At press time, XRP traded at $0.51945.