- May 13, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

After the record-breaking DeFi summer of 2020, the crypto industry has gone parabolic when adopting decentralized technologies.

The industry has been racing to reinstate traditional financial services in the decentralized world throughout the last year, drastically expanding the DeFi market.

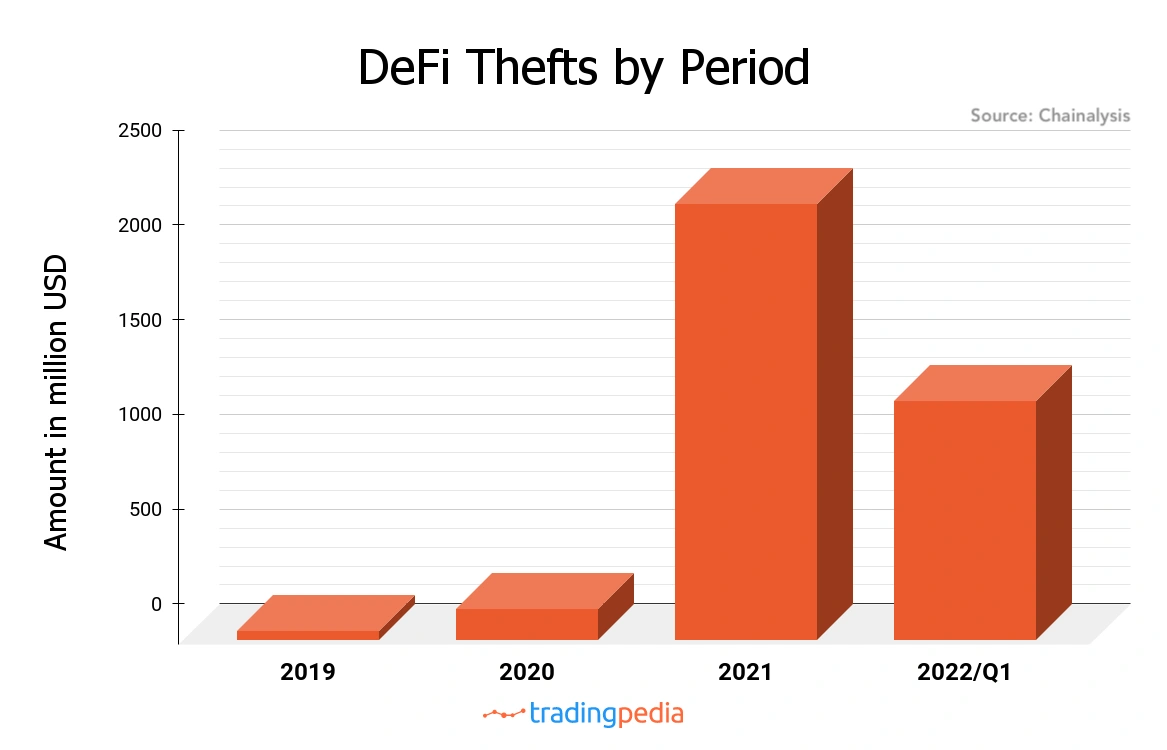

However, the rampant and unchecked growth of DeFi came at a price — $2.3 billion, to be exact. That’s the total value of cryptocurrencies stolen in DeFi hacks and thefts last year, representing a 1,330% increase compared to 2020.

The latest data analysis from TradingPedia shows that this trend has worsened in 2022 and could continue to worsen even more as the year progresses.

In a report shared with CryptoSlate, TradingPedia found that just in the first quarter of 2022, there has been $1.26 billion worth of cryptocurrencies stolen from DeFi protocols. This constitutes 55% of all DeFi thefts for the entire of 2021.

Half of this amount was stolen in the now infamous Ronin Network hack, which saw over $615 million worth of ETH and USDC drained from the bridge between the Ronin Chain and the Ethereum mainnet.

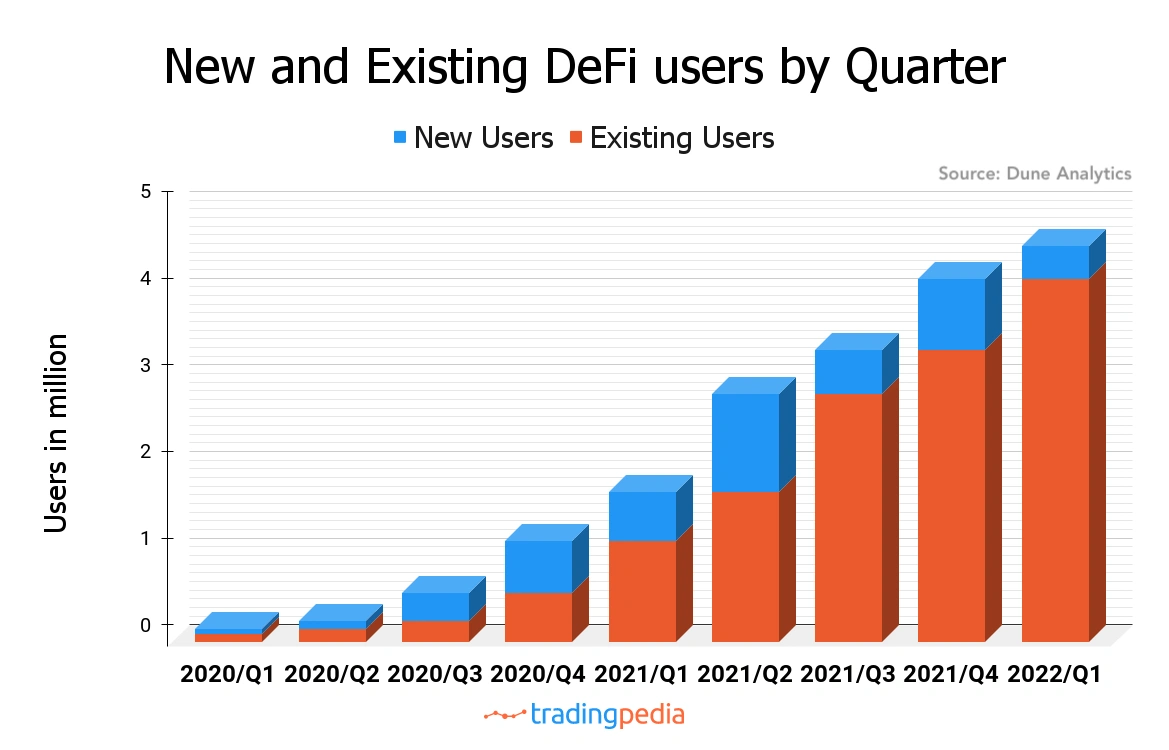

Brian McColl, a technical analysis expert at TradingPedia, told CryptoSlate that the increased interest in DeFi led to an upsurge in malicious intent towards exploiting DeFi protocols for financial gains.

“This upsurge is so substantial that about 97% of all crypto stolen in Q1 of 2022 is attributed to DeFi protocols,” McColl explained. “This is leading to fear and uncertainty in existing and prospective customers, clearly indicated in the drop in new DeFi users—the first quarter of 2022 is the first to see a single-digit percentage of user growth on a quarterly basis since the “early days” of 2019.”

The second quarter of the year hasn’t failed to deliver on this trend.

On April 17th, DeFi protocol Beanstalk Farms lost over $180 million to an exploit that allowed a hacker to pass a governance proposal that drained all the funds on the protocol into the hacker’s wallet.

On April 22nd, a hacker exploited a vulnerability in DeFi protocol Zeed and stole over $1 million worth of funds before locking them in a self-destruct contract.

Days later, NFT project AkuDreams suffered a bug that caused $34 million in proceeds from the NFT sales to be locked in a smart contract forever. The same week, Deus DAO lost over $13.4 million worth of ETH to a hacker less than a month after being exploited in a similar flash loan attack for roughly $3 million.

And while we’re yet to see a major exploit in May, the month wasn’t up to a good start—on May 3rd, the Solana network went offline for over seven hours following a bot attack that flooded the network.

Declining trust in DeFi fuels CBDC pilots

At TrustPedia, analysts believe that the rising number of DeFi exploits has inadvertently caused another controversial sector of the crypto market to bloom—central bank digital currencies (CBDCs).

“I believe the future of DeFi is intertwined with CBDCs,” McColl said. “DeFi needs urgent drastic improvements in terms of security and CBDCs may be the framework to give DeFi legitimacy and make regular users feel safe with their funds.”

Currently, many central banks are at different stages of researching, developing, and running pilots with their own digital national currencies. McColl believes that CBDCs have some significant advantages over stablecoins regarding security and their ability to integrate with current financial systems. Digital national currencies will be able to incorporate user identity and KYC policies natively and can be integrated with existing tax and accounting systems, he added.

Central banks seem eager to jump on the DeFi bandwagon. At the beginning of April, the Bank for International Settlements (BIS) held a conference on this topic. Called “Does safe DeFi require CBDCs?” the meeting saw the top management at BIS discuss the possibility of using CBDCs in DeFi with regulators, academics, crypto founders, and developers.

However, bringing CBDCs to the world of DeFi is easier said than done. Aside from the technical and legal limitations, the endeavor would certainly meet strong resistance from the market, which could fight to protect the “De” in “DeFi.” There’s also the question of whether the integration of CBDCs to the DeFi market would decrease both the number of hacks and the amount of funds that get stolen.

McColl seems to agree with this:

“This, of course, comes at a price—you can’t claim to be “decentralized” when you’re using a central bank’s digital currency. We are surely witnessing the establishment of the future digital financial system that is coming after the one we have now. I think 2022 will be one of the pivotal years in this transition.”

The post Record amounts of crypto were stolen in DeFi hacks last quarter appeared first on CryptoSlate.