- September 20, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Previous research conducted by CryptoSlate suggested the Ethereum Merge would be a buy-the-rumor, sell-the-news event.

With that coming to pass, as ETH sunk 20% over the last seven days, what does a current analysis of the derivatives market reveal?

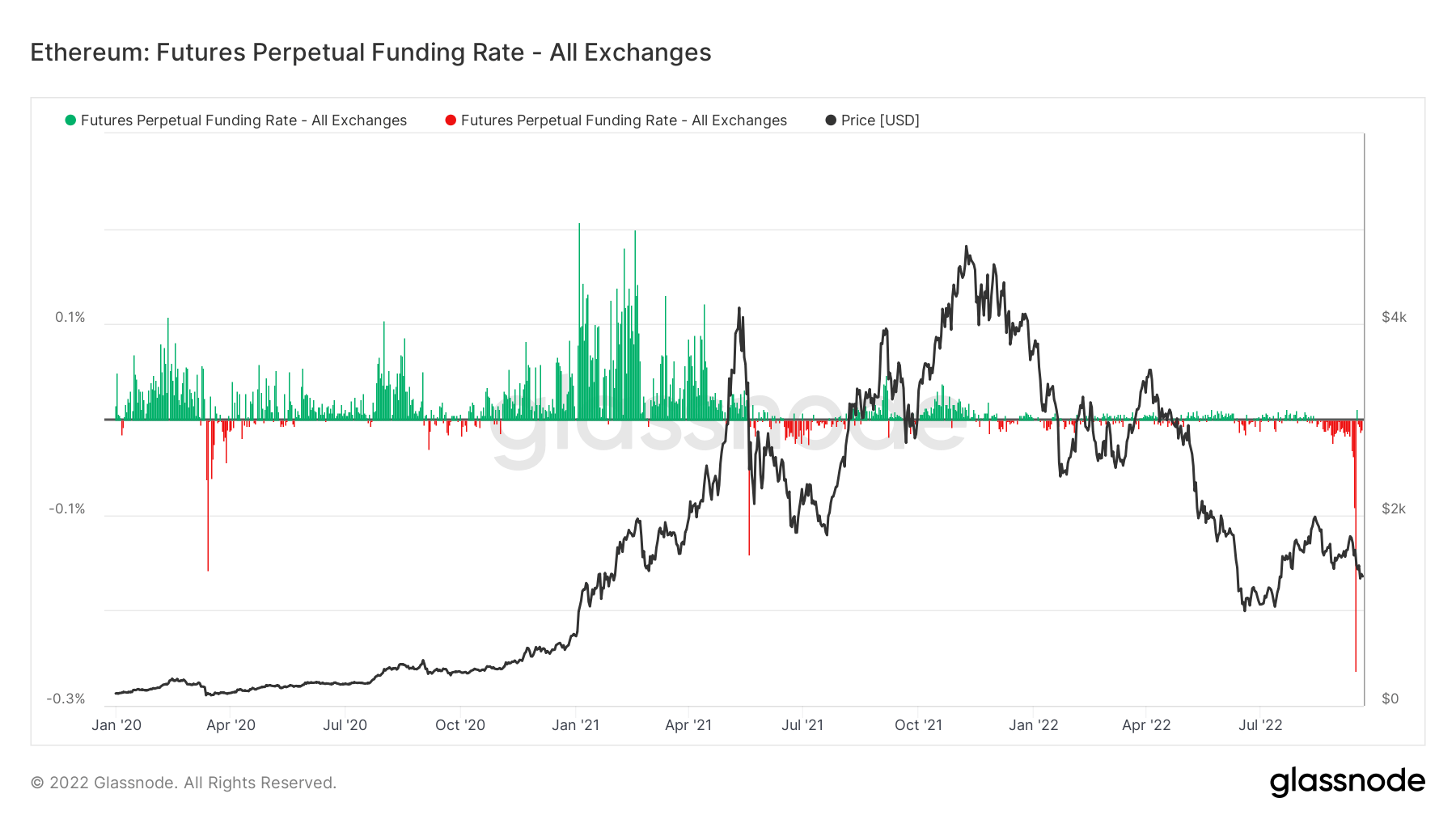

Ethereum Futures Perpetual Funding Rate

Perpetual Funding Rates refer to periodic payments made to or by derivatives traders, both long and short, based on the difference between perpetual contract markets and the spot price.

During periods when the funding rate is positive, the price of the perpetual contract is higher than the marked price. Therefore, long traders pay for short positions. In contrast, a negative funding rate shows perpetual contracts are priced below the marked price, and short traders pay for longs.

They differ from standard futures contracts in that the perpetual element means traders can hold positions without the contract expiring. But the purpose of funding rates is to serve as a mechanism for keeping contract prices in line with spot markets.

The chart below shows that as the Merge approached, traders were paying almost 1,200% annualized funding rates to short Ethereum. The scale of shorting surpassed the levels seen during the height of the covid crisis.

Post-Merge, the funding rate has reverted to near neutral, suggesting short-term speculation is over, and the funding premium has vanished accordingly.

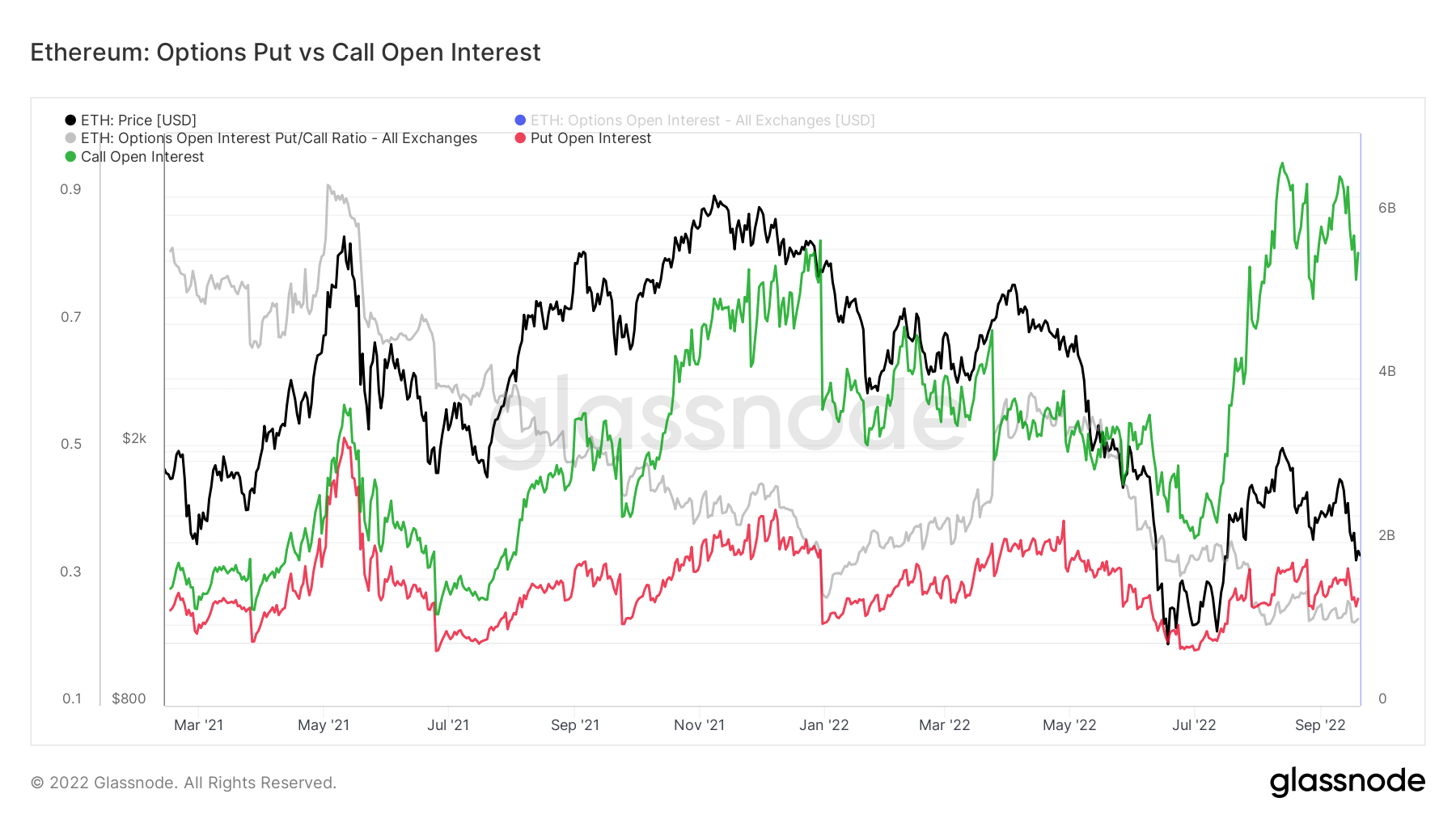

Options Put vs. Call Open Interest

Open Interest refers to the number of active options contracts. These are contracts that have been traded but not yet liquidated by an offsetting trade or assignment. A put option is the right to sell at a specific price by a specified date, whereas a call is the right to buy at a particular price by a specified date.

The chart below showed both put and call options have sunk post-Merge. Calls remain elevated, with more than $5 billion still in force, whereas puts remain relatively muted.

This suggests traders are still willing to go long despite the post-Merge price correction.

The post Research: State of Ethereum derivatives market post-Merge appeared first on CryptoSlate.