- February 12, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

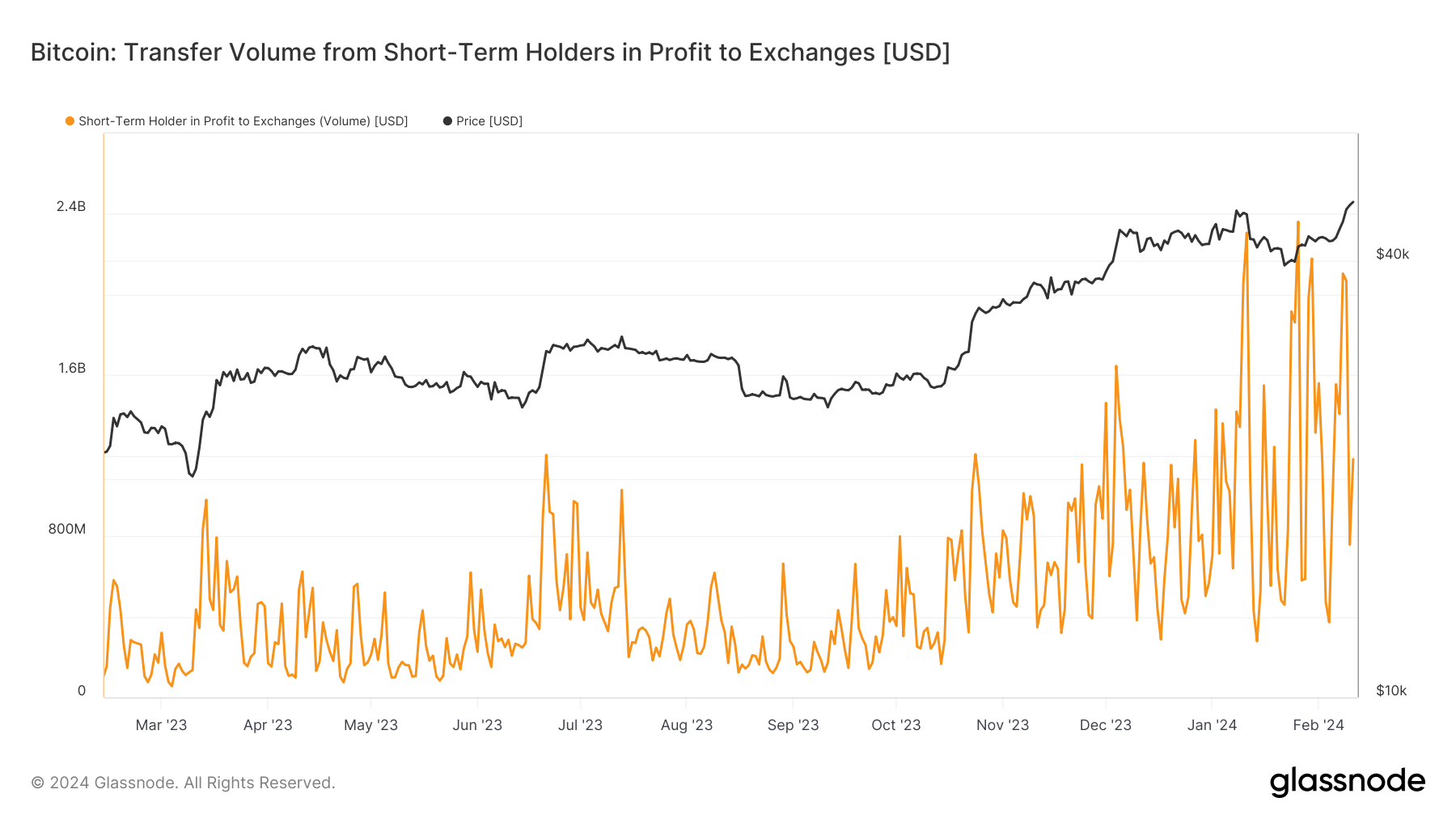

Recent data analysis has uncovered fascinating patterns in the behavior of short-term Bitcoin holders—investors who have held their Bitcoin for less than 155 days.

This cohort, known for its propensity towards speculation, has been shown to influence Bitcoin’s market conditions significantly. The launch of the Bitcoin ETF on Jan. 11 marked a period of significant activity from these investors.

Upon Bitcoin reaching a high of $49,000, substantial profit-taking was observed. However, the subsequent fall of Bitcoin to below $40,000 triggered a record transfer of Bitcoin held at a loss to exchange wallets.

The recent resurgence of Bitcoin to $48,000 has triggered a notable influx of profit to exchanges. Over two consecutive days, Feb. 8 and 9, exchanges saw over $2 billion in profits transferred daily, almost echoing the activity seen when Bitcoin hit $49,000. These findings underline the influence short-term holders can exert on the Bitcoin market.

The post Short-term Bitcoin holders send over $4B in profit to exchanges appeared first on CryptoSlate.