- June 12, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Quick Take

- In a deflationary collapse, a sell-off occurs that first results in leverage being wiped out first before then affecting panic sellers.

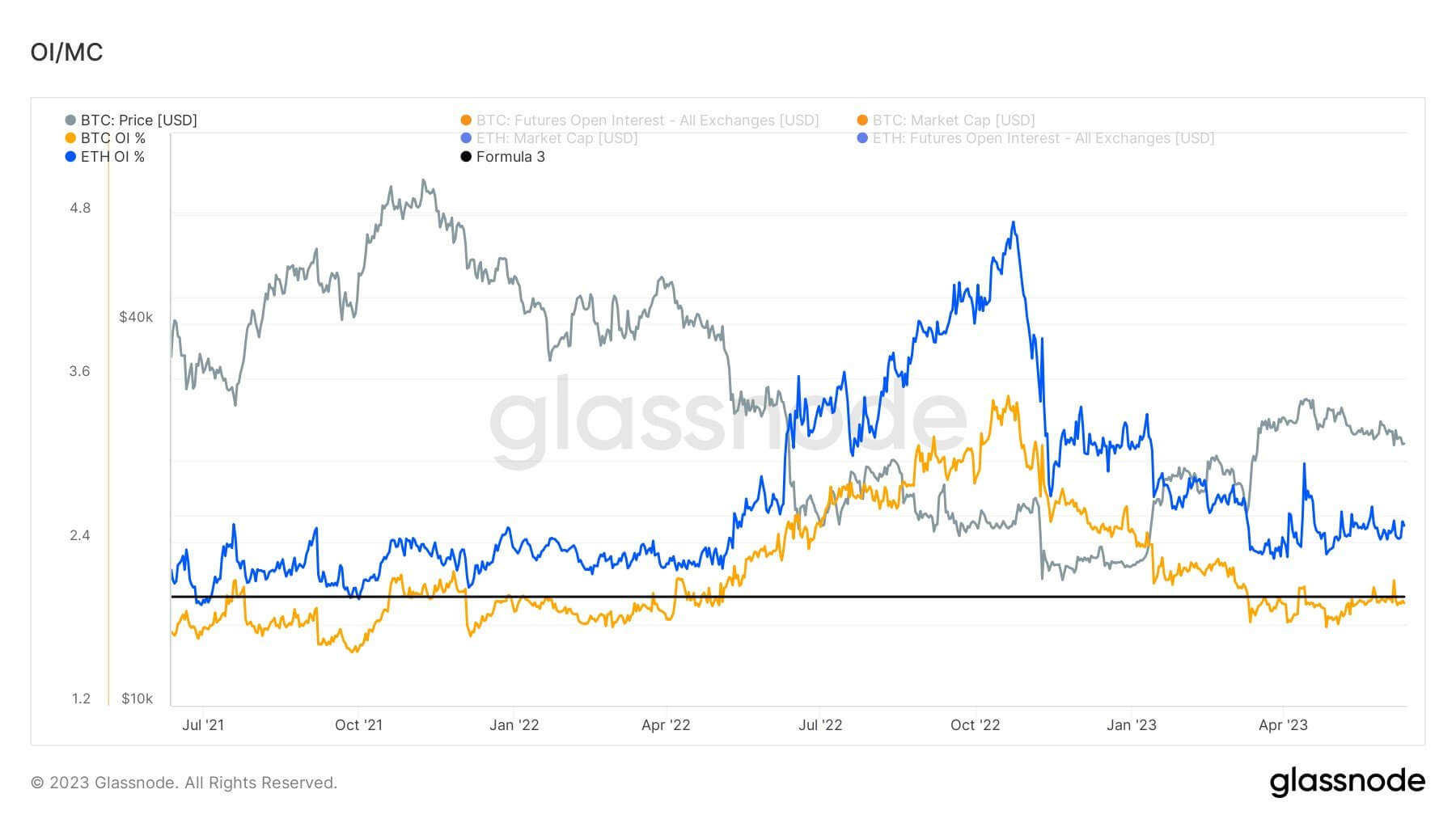

- Bitcoin open interest is minimal, remaining at or below 2% of the market cap since Silicon Valley Bank’s collapse, while holders remain price agnostic.

- The current value of the futures open interest is roughly $9.8 billion, while the market cap is just over $500 billion.

- Ethereum’s open interest is slightly more leveraged than Bitcoin in terms of open interest compared to market cap.

- Ethereum’s open interest divided by market cap is 2.5%, roughly $5.2 billion in open interest with a market cap of $210 billion.

- We can also see a lack of long-term holders sending Bitcoin to exchanges since the SVB collapse in March.

The post Should we fear a deflationary collapse in Bitcoin? appeared first on CryptoSlate.