- February 8, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

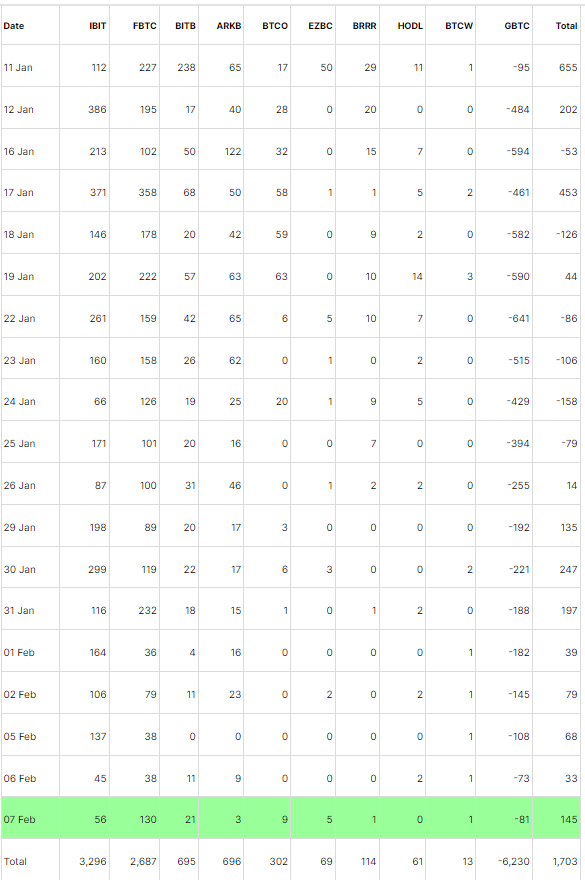

On Feb. 7, spot Bitcoin ETF products witnessed a solid net inflow, marking the ninth consecutive day of net inflows, Farside Investors data shows.

This inflow was the highest so far in February, with Farside Investors reporting a hefty $145 million net inflow. Fidelity’s FBTC emerged as the frontrunner, registering $130 million in net inflows. This was FBTC’s highest net inflow since Jan. 31, boosting its total net inflows to $2.7 billion.

Meanwhile, BlackRock’s IBIT exhibited a modest $56 million net inflow, a figure that elevated its total net inflows to a hefty $3.3 billion. On the other hand, according to Farside Investors, GBTC experienced a minor net outflow of $81 million, deepening its total net outflows to a stark -$6.2 billion.

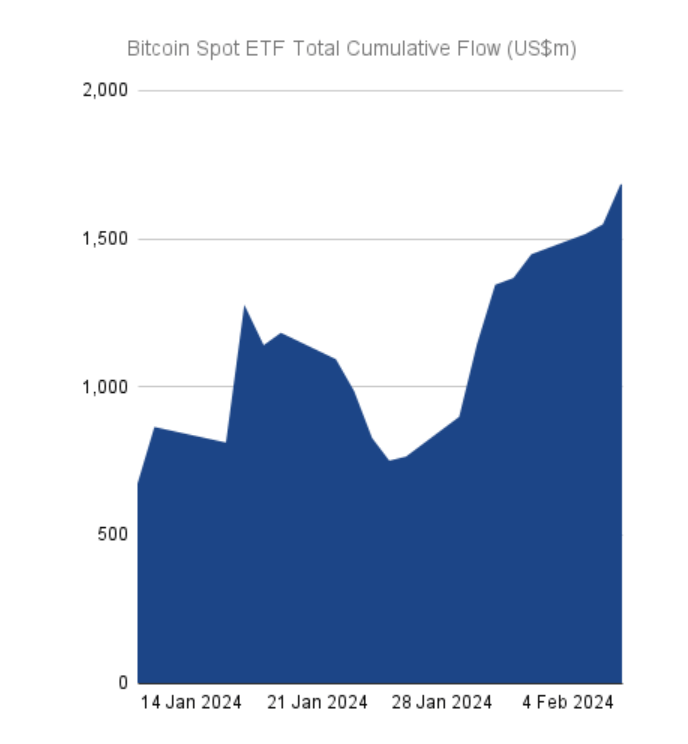

Despite the GBTC outflows, the overall scene remained positive, with total net inflows reaching a robust $1.7 billion, indicating investor confidence in Bitcoin ETF products.

The post Spot Bitcoin ETFs see ninth consecutive day of inflows with Fidelity leading the charge on the day appeared first on CryptoSlate.