- August 25, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

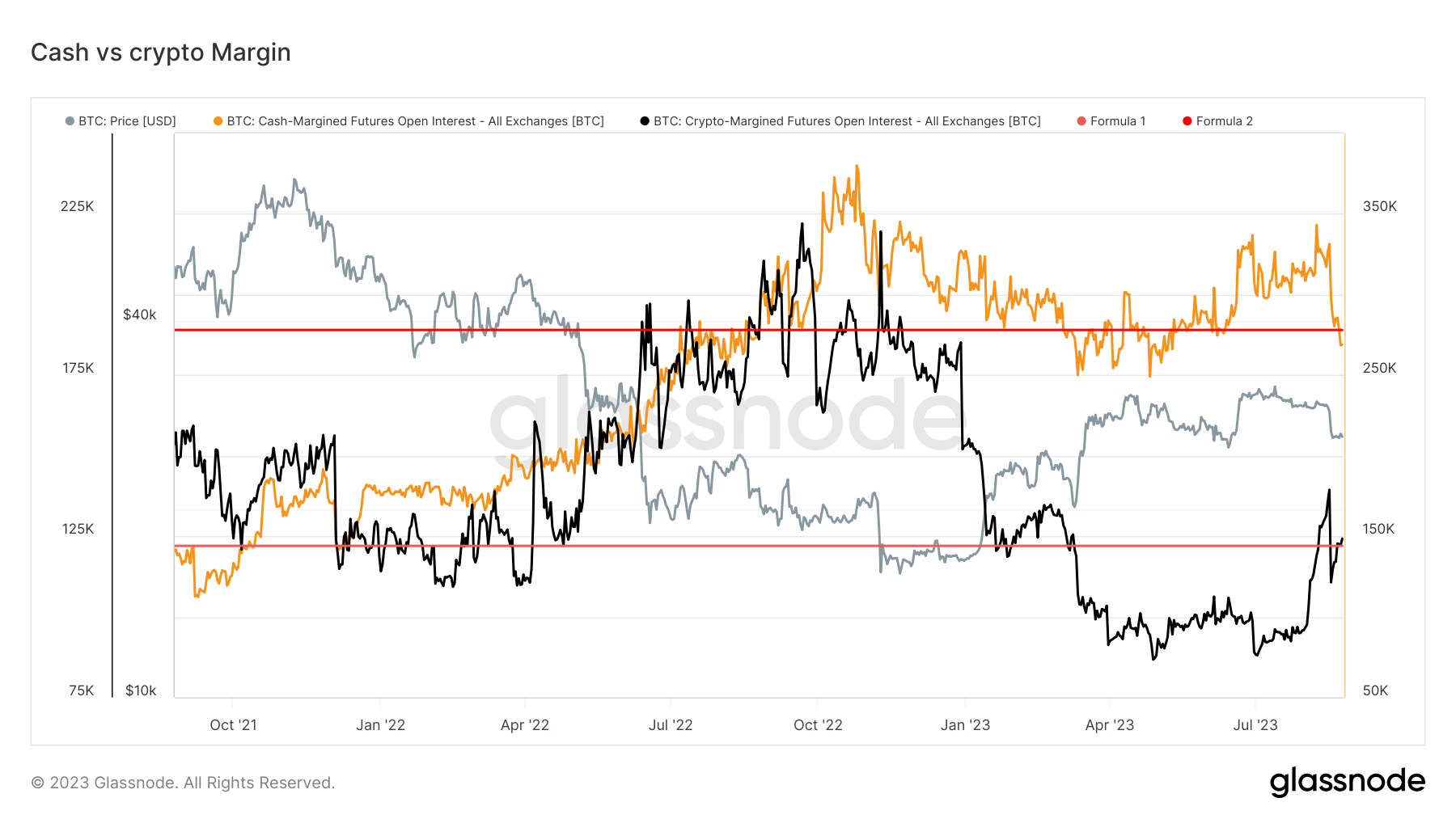

A notable divergence in futures contracts open interest, margined in USD or USD-pegged stablecoins versus those margined in native coins like Bitcoin, is beginning to emerge. Stablecoins in question include USDT and BUSD. The growing chasm shows contrasting preferences and risk assessments by players in the crypto space.

Crypto margin, underpinned by collateral such as Bitcoin, is surging to year-to-date highs, indicating an increased willingness among traders to take on greater risks. In contrast, cash margin, linked to USD or USD-pegged stablecoins, is edging towards year-to-date lows. This trend signifies a defensive stance, likely in response to perceived uncertainty or volatility.

Interestingly, the crypto margin as a percentage stands at 32%. With each spike in this figure, Bitcoin has historically registered a new local low, hinting at a potential correction or price consolidation in response to increased margin trading activity.

The post Surge in Bitcoin-margined futures signals gambler’s rush amidst market uncertainty appeared first on CryptoSlate.