- July 31, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The crypto market, led by Bitcoin (BTC), has shown a bearish trend in the past week, with the leading digital asset slipping to a new 30-day low of $28,925. Meanwhile, the US stock indices continued to outperform Bitcoin, reflecting the divergence between traditional markets and the crypto space.

As the market heads into a new week, several key factors could impact Bitcoin’s und the altcoins’ next direction. Here’s what to watch:

Economic Data And Corporate Earnings

The first trading week in August is rather quiet from a macroeconomic perspective. It will kick off with the release of the US JOLTS jobs report on Tuesday, August 1, 10:00 am EST. This report, which provides insights into labor market conditions, could influence investor sentiment. A stronger than expected report may boost confidence in the economy. Conversely, a weaker report could trigger a flight to safety, strengthening the US-Dollar Index (DXY).

Thursday, August 3, 8:30 am EST brings the Unemployment Claims report. An increase in claims could signal economic distress. On the other hand, a decrease in claims could indicate economic recovery, possibly further boosting the stock market.

The week concludes with the Unemployment Rate report on Friday, August 4, 8:30 am EST. A high unemployment rate could lead to a growing fear of a recession, putting stocks and crypto under pressure.. Conversely, a low unemployment rate could lead to a bullish trend for Bitcoin and other cryptocurrencies as confidence in the traditional economy grows.

In addition to these macro events, the earnings week continues with some major companies reporting, including Amazon (AMZN), Apple (AAPL), Advanced Micro Devices (AMD), PayPal Shopify (SHOP) and Coinbase (COIN). These reports could have indirect effects on the crypto market, particularly Coinbase (on Aug. 3), given its status as a leading cryptocurrency exchange.

Bitcoin And Crypto Market Sentiment

While macroeconomic events, particularly Fed interest rate decisions, the performance of the DXY, and inflation data have historically had a major impact on BTC and crypto prices, that correlation has all but disappeared in recent weeks. Therefore, Todd Butterfield, owner of the Wyckoff Stock Market Institute, gave a preview of this week, stating:

Bitcoin traded below $29,000 last week, as we had called for, on low volume. We are still looking for a better buy setup for Bitcoin. The technometer is neutral, so we are still on the sidelines at the moment. We are not happy that bitcoin has not followed the rise in equities in recent weeks. This gives us pause. The technometer is neutral at 43.3.

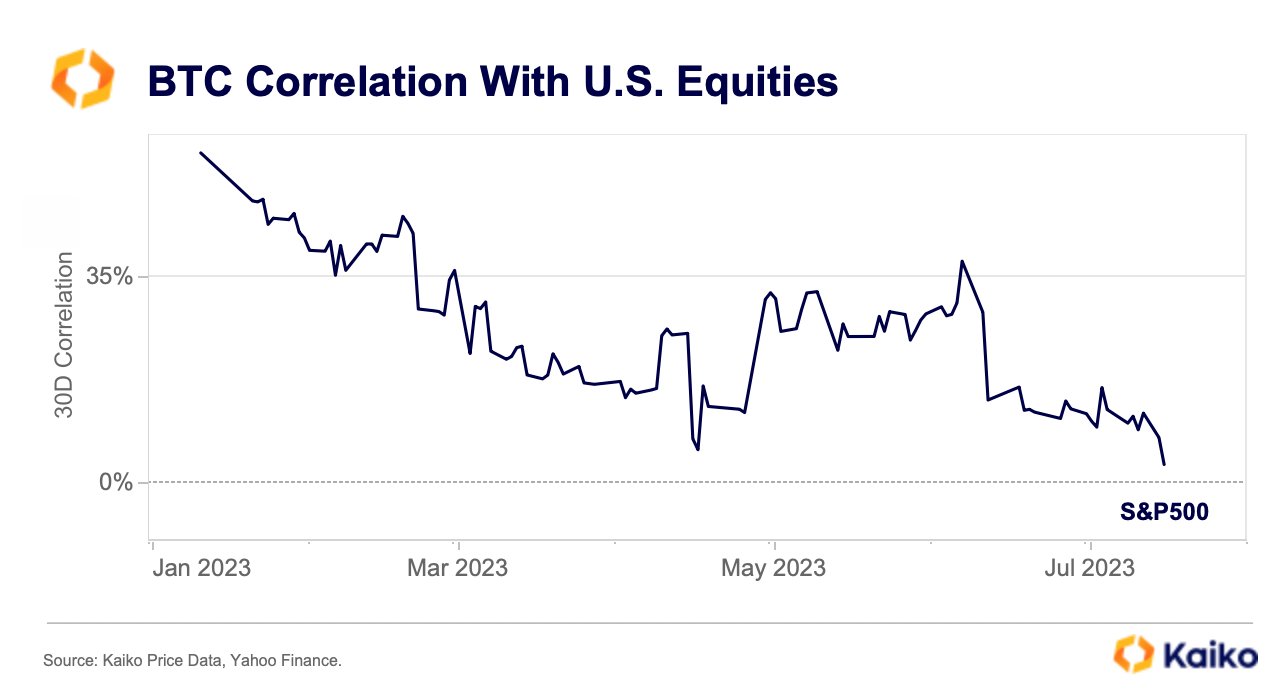

Data from Kaiko also shows a sharp decline in 90-day realized volatility for both BTC and ETH, which are at two-year lows. Interestingly, BTC’s correlation with the S&P 500 has also continued to fall to historic lows, reaching just 3% in July. Kaiko tweeted:

Bitcoin’s correlation with the S&P 500 continued to fall in July, reaching just 3%. The last time it was this low was in August 2021.

In recent weeks, BTC has also lost its inverse correlation to the US dollar index (DXY) and thus to macro events. However, unlike previous periods, Bitcoin and crypto investors may currently want correlation with the S&P 500, as it is on a strong uptrend due to macroeconomic data and the recent FOMC meeting.

However, the crypto market has not reacted to macro data in recent weeks. What is important to note is that the non-correlation between BTC and macroeconomic events will not last forever, though. The moment liquidity returns to the market, the correlation will likely return.

Before that, it will likely take another crypto-intrinsic event to wake Bitcoin and the broader market from their summer slumber. A ruling in the Bitcoin Spot ETF case between Grayscale and the U.S. Securities and Exchange Commission, or even a decision on the BlackRock application, could be possible catalysts.

At press time, the Bitcoin price was at $29,417.