- January 10, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Following the potential approval of the first spot Bitcoin ETFs in the United States by the Securities and Exchange Commission (SEC), the crypto investment sector is poised for a potential shift towards other significant digital assets, notably Ethereum and XRP. While the SEC currently has several applications for spot Ethereum ETFs under review, the situation for XRP ETFs is notably different, with no applications filed to date.

However, the landscape could change rapidly, according to Steven McClurg, Chief Investment Officer at Valkyrie Investments. Valkyrie Invest is currently one of 11 applicants awaiting approval of its application for a spot Bitcoin ETF. Just yesterday, Valkyrie CIO Steven McClurg stated in an interview that he expects a spot Bitcoin ETF approval today (Wednesday) and trading to begin tomorrow (Thursday).

XRP ETF Filings Could Be Submitted To The SEC Soon

In a TV appearance for Bloomberg Crypto, McClurg commented on the prospects for a spot XRP ETF. When asked by presenter Sonali Basak about “How soon before you turn around and try to make other spot products for different crypto assets,” McClurg answered:

You know I think we’re going to see a lot of filings come out for Ethereum. I even think we might see something for Ripple given the recent progress. You notice that Grayscale just added Ripple to one of their trust is publicly traded. So it wouldn’t surprise me if we saw Ripple or Ethereum spot ETFs out there.

McClurg’s remarks reflect a broader industry sentiment that with the SEC’s green light for Bitcoin ETFs, doors might open for other cryptocurrencies. Commenting on Valkyrie strategy, he stated: “I really don’t know if we’re going to do that or not. I think those are more retail plays and people have other ways to access them. But given that in this market anything could happen, anything could happen.”

Notably, the crypto community has shown heightened interest in the possibility of an XRP ETF. The term “XRP ETF” was trending on X just two days ago. This buzz was partly ignited by Grayscale Investments’ decision to reintegrate the cryptocurrency into its Grayscale Digital Large Cap (GDLC) Fund.

Moreover, there have been claims within the community suggesting that Fidelity Investments has introduced an XRP Exchange-Traded Product (ETP). However, these reports were inaccurate, as Fidelity has not released any such ETP. What Fidelity’s platform does feature is 21Shares’ XRP ETP. It is listed on the Swiss Exchange SIX and is important to note that this ETP is not registered in the United States.

A Major Hurdle

Not every expert believes in the possibility of an XRP ETF. Bloomberg ETF analyst James Seyffart offered a more cautious perspective a few months ago: “I don’t think that XRP is ever going to get through the SEC’s doors, essentially not anytime soon, even after that loss [Ripple vs. SEC].”

He elaborated that before considering a spot XRP ETF, the Chicago Mercantile Exchange (CME) would need to list XRP futures as a regulated market of sufficient size, a prerequisite that currently seems distant.

Seyffart’s analysis underscores the nuanced and challenging regulatory environment for cryptocurrencies in the US, especially for assets like XRP, which have been under intense scrutiny. The potential for an XRP ETF hinges not only on market demand but also on a complex interplay of regulatory milestones and market readiness.

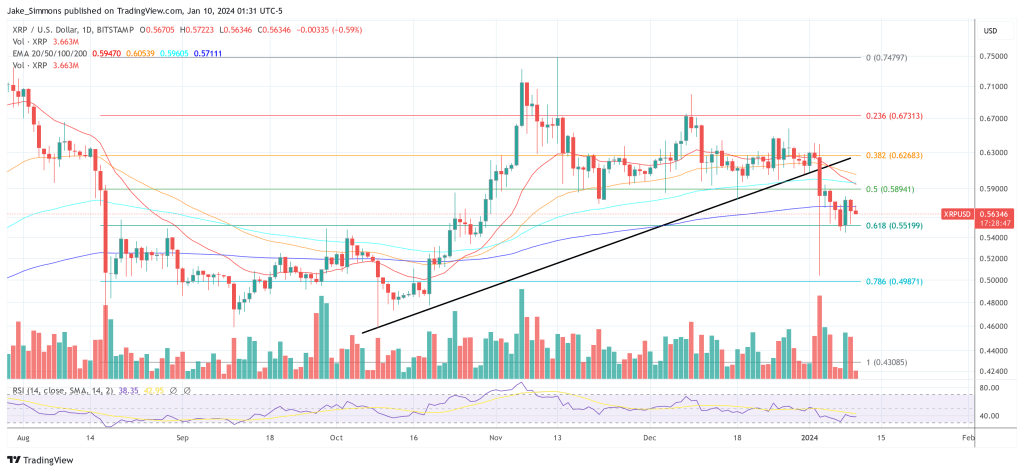

At press time, XRP traded at $0.56346.